Print: 03 Nov 2025

NRBC Bank audit uncovers major accounting irregularities, inflated profits

The most critical finding was the non-recognition of loan loss provisions, which auditors said distorted the bank’s true financial position

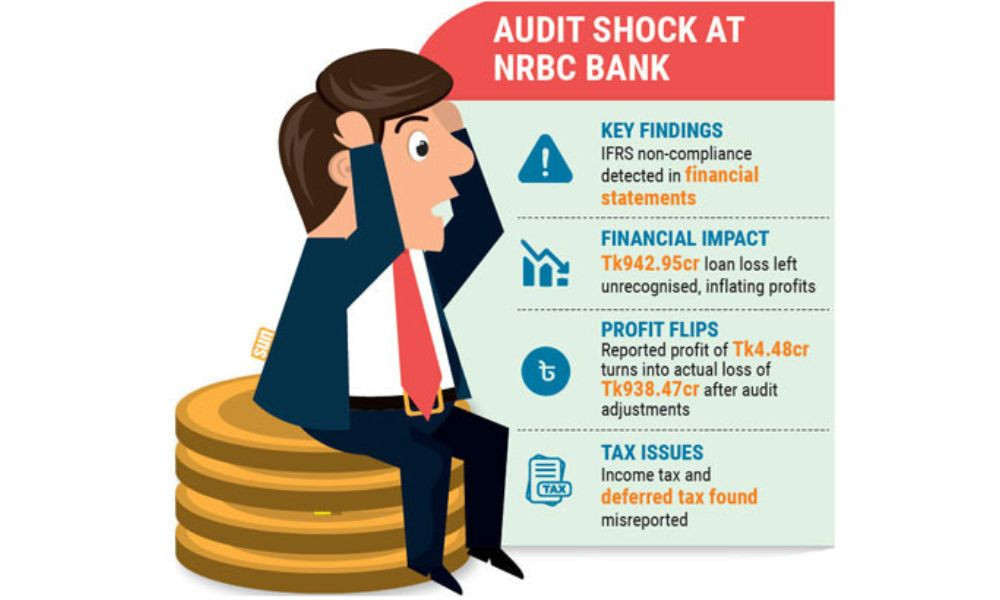

NRB Commercial Bank (NRBC), a fourth-generation private lender, is facing intense scrutiny after a recent audit uncovered significant accounting irregularities that auditors say may have falsely inflated profits and concealed a massive loss.

The audit report found the bank's financial statements non-compliant with international accounting standards across several areas, including lease accounting, income tax, and employee benefits.

The most critical finding was the non-recognition of loan loss provisions, which auditors said distorted the bank’s true financial position.

According to the report, NRBC Bank reported a net profit after tax of Tk4.48 crore for 2024, with a net worth of Tk1,329.75 crore, earnings per share (EPS) of Tk0.05, and a net asset value (NAV) per share of Tk16.05.

However, the bank deferred recognition of Tk942.95 crore in loan loss provisions required by Bangladesh Bank.

Auditors noted that if the full provision had been recorded, NRBC would have reported a net loss after tax of Tk938.47 crore, a net worth of Tk396.23 crore, an EPS of Tk-11.33, and a NAV per share of Tk4.78, indicating that the deferment effectively masked a massive loss. Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said weak governance and corruption were at the root of the crisis.

“Many of these loans had turned sour much earlier but were officially recognised as non-performing only in 2024,” he told the Daily Sun, adding that existing laws are sufficient to hold those responsible accountable if properly enforced.

Following a change in government, Bangladesh Bank launched sweeping reforms to restore discipline in the financial sector, dissolving the boards of 14 banks.

Under newly appointed Governor Dr Ahsan H. Mansur, the central bank has initiated structural reforms aimed at strengthening governance and transparency across financial institutions.

As part of these efforts, the Parvez Tamal-led NRBC Bank board was dissolved in March, and a new board was formed with former Bangladesh Krishi Bank Managing Director Ali Hossain Prodhania as chairman.

The audit also cited several violations of International Financial Reporting Standards (IFRS).

Under IFRS 16, governing lease accounting, NRBC’s measurement of Right-of- Use (ROU) assets and lease liabilities across 26 branches was found inconsistent, overstating ROU assets by Tk0.92 crore and lease liabilities by Tk0.74 crore, while other branches showed understatements of Tk19.19 crore and Tk17.85 crore, respectively.

In tax reporting, auditors found discrepancies under IAS 12 (Income Taxes).

The bank’s current income tax payable was overstated by Tk10.4 crore, and prior-year adjustments of Tk1.39 crore were not recognised.

Deferred tax assets were understated by over Tk300 crore, and deferred tax income was misstated by more than Tk14 crore.

The audit further revealed that NRBC failed to conduct an actuarial valuation for its Defined Benefit Gratuity Scheme as required under IAS 19. Instead, the bank calculated gratuity provisions based solely on years of service. Auditors warned that this non-compliance could have led to significant misstatements in employee benefit obligations, profits, and equity, alongside insufficient disclosures.

Multiple attempts to reach Chairman Md Ali Hossain Prodhania and Bank Secretary Mohammad Ahsan Habib for comment were unsuccessful.

Economists say the NRBC case highlights deep-rooted governance failures in private banking and underscores the urgent need for stronger oversight. As investigations continue, the case is being viewed as a key test of the interim government’s resolve to restore public confidence in the country’s financial system.

The reporter can be reached at: [email protected]

Edited by: Anayetur Rahaman

NRBC Bank audit uncovers major accounting irregularities, inflated profits

The most critical finding was the non-recognition of loan loss provisions, which auditors said distorted the bank’s true financial position

NRB Commercial Bank (NRBC), a fourth-generation private lender, is facing intense scrutiny after a recent audit uncovered significant accounting irregularities that auditors say may have falsely inflated profits and concealed a massive loss.

The audit report found the bank's financial statements non-compliant with international accounting standards across several areas, including lease accounting, income tax, and employee benefits.

The most critical finding was the non-recognition of loan loss provisions, which auditors said distorted the bank’s true financial position.

According to the report, NRBC Bank reported a net profit after tax of Tk4.48 crore for 2024, with a net worth of Tk1,329.75 crore, earnings per share (EPS) of Tk0.05, and a net asset value (NAV) per share of Tk16.05.

However, the bank deferred recognition of Tk942.95 crore in loan loss provisions required by Bangladesh Bank.

Auditors noted that if the full provision had been recorded, NRBC would have reported a net loss after tax of Tk938.47 crore, a net worth of Tk396.23 crore, an EPS of Tk-11.33, and a NAV per share of Tk4.78, indicating that the deferment effectively masked a massive loss. Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said weak governance and corruption were at the root of the crisis.

“Many of these loans had turned sour much earlier but were officially recognised as non-performing only in 2024,” he told the Daily Sun, adding that existing laws are sufficient to hold those responsible accountable if properly enforced.

Following a change in government, Bangladesh Bank launched sweeping reforms to restore discipline in the financial sector, dissolving the boards of 14 banks.

Under newly appointed Governor Dr Ahsan H. Mansur, the central bank has initiated structural reforms aimed at strengthening governance and transparency across financial institutions.

As part of these efforts, the Parvez Tamal-led NRBC Bank board was dissolved in March, and a new board was formed with former Bangladesh Krishi Bank Managing Director Ali Hossain Prodhania as chairman.

The audit also cited several violations of International Financial Reporting Standards (IFRS).

Under IFRS 16, governing lease accounting, NRBC’s measurement of Right-of- Use (ROU) assets and lease liabilities across 26 branches was found inconsistent, overstating ROU assets by Tk0.92 crore and lease liabilities by Tk0.74 crore, while other branches showed understatements of Tk19.19 crore and Tk17.85 crore, respectively.

In tax reporting, auditors found discrepancies under IAS 12 (Income Taxes).

The bank’s current income tax payable was overstated by Tk10.4 crore, and prior-year adjustments of Tk1.39 crore were not recognised.

Deferred tax assets were understated by over Tk300 crore, and deferred tax income was misstated by more than Tk14 crore.

The audit further revealed that NRBC failed to conduct an actuarial valuation for its Defined Benefit Gratuity Scheme as required under IAS 19. Instead, the bank calculated gratuity provisions based solely on years of service. Auditors warned that this non-compliance could have led to significant misstatements in employee benefit obligations, profits, and equity, alongside insufficient disclosures.

Multiple attempts to reach Chairman Md Ali Hossain Prodhania and Bank Secretary Mohammad Ahsan Habib for comment were unsuccessful.

Economists say the NRBC case highlights deep-rooted governance failures in private banking and underscores the urgent need for stronger oversight. As investigations continue, the case is being viewed as a key test of the interim government’s resolve to restore public confidence in the country’s financial system.

The reporter can be reached at: [email protected]

Edited by: Anayetur Rahaman