Print: 28 Oct 2025

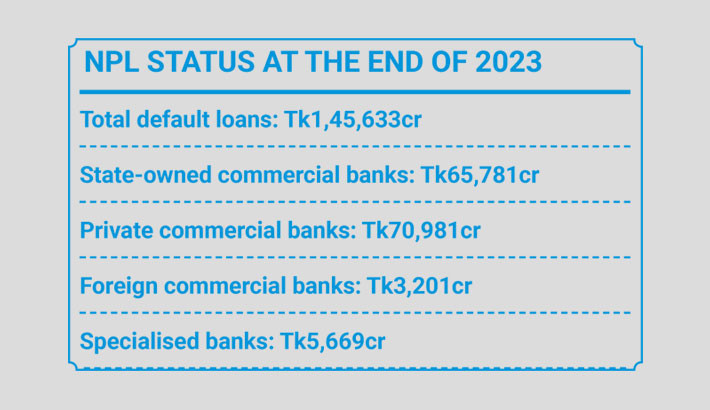

Non-performing loans (NPLs) in the country’s banking sector reached Tk1,45,633 crore at the end of last year, up by 20.7% compared to that in the year before.

According to data obtained from the Bangladesh Bank, the total default loans in the banking system at the end of 2022 were Tk1,20,656 crore.

The bad loans were 9% of the sector’s total outstanding loans of Tk16,17689 crore last year.

Recently, the central bank finalized a roadmap to bring down default loans below 8% by June 2026 to ensure corporate governance in the banking sector.

The regulator also prepared an actionplan aiming at reducing nonperforming loans (NPLs) of state-owned commercial banks below 10% and private commercial banks below 5% within the next two and a half years.

As per the Bangladesh Bank data, at the end of 2023, NPLs stood at Tk65,781 crore in the state-owned commercial banks, which was 20.99% of their total outstanding loans.

Meanwhile, private commercial banks’ NPLs stood at Tk70,981 crore, which was 5.93%.

At the same time, the foreign commercial banks recorded Tk3,201 crore in NPLs at the end of December 2023, which was 4.82% of their total outstanding loans.

And the specialised banks’ NPLs were Tk5,669 crore at the end of last year.

Default loans surge 21% in 2023

Non-performing loans (NPLs) in the country’s banking sector reached Tk1,45,633 crore at the end of last year, up by 20.7% compared to that in the year before.

According to data obtained from the Bangladesh Bank, the total default loans in the banking system at the end of 2022 were Tk1,20,656 crore.

The bad loans were 9% of the sector’s total outstanding loans of Tk16,17689 crore last year.

Recently, the central bank finalized a roadmap to bring down default loans below 8% by June 2026 to ensure corporate governance in the banking sector.

The regulator also prepared an actionplan aiming at reducing nonperforming loans (NPLs) of state-owned commercial banks below 10% and private commercial banks below 5% within the next two and a half years.

As per the Bangladesh Bank data, at the end of 2023, NPLs stood at Tk65,781 crore in the state-owned commercial banks, which was 20.99% of their total outstanding loans.

Meanwhile, private commercial banks’ NPLs stood at Tk70,981 crore, which was 5.93%.

At the same time, the foreign commercial banks recorded Tk3,201 crore in NPLs at the end of December 2023, which was 4.82% of their total outstanding loans.

And the specialised banks’ NPLs were Tk5,669 crore at the end of last year.