Print: 02 Nov 2025

TRADE WITH MALAYSIA

Big potential, bigger deficit

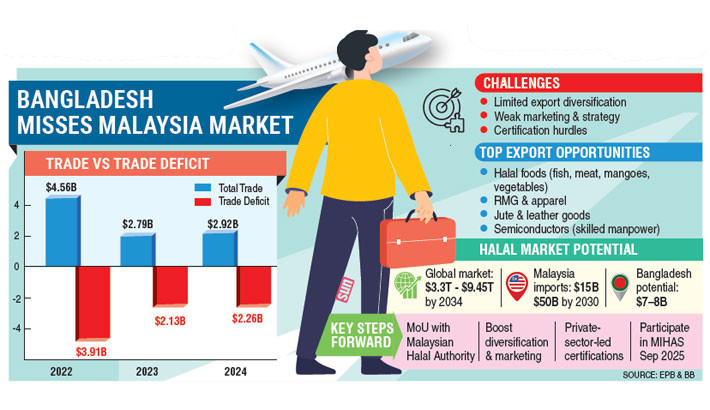

Despite five decades of ties, Bangladesh struggles to narrow a $2b trade gap due to poor export diversification, weak marketing, and certification hurdles

Despite more than five decades of diplomatic ties, Bangladesh has failed to reduce its trade deficit of over US$2 billion with Malaysia, mainly due to a lack of export diversification, market research, strategy, and certification processes.

Economists and industry insiders see strong potential in halal foods, fish, meat, vegetables, fruits, particularly mangoes, readymade garments (RMG), jute and leather goods, other agro-products, and skilled manpower in the semiconductor sector.

According to data compiled by the Dhaka Chamber of Commerce & Industry (DCCI) from the Export Promotion Bureau (EPB) and Bangladesh Bank, total bilateral trade stood at $2.92 billion in 2024, $2.79 billion in 2023, and $4.56 billion in 2022.

Bangladesh’s exports totalled $329.39 million in 2024, $329.18 million in 2023, and $325.16 million in 2022, leaving a trade gap of $2.26 billion, $2.13 billion, and $3.91 billion respectively.

‘Market research and diversification are key’

Speaking to the Daily Sun over phone, Dr Mohd Ma’Sum Billah, senior professor of finance at King Abdul Aziz University, said Bangladesh has been unable to fully tap the Malaysian market despite being a Muslim-majority country.

“The problem lies in weak market research, lack of export diversification, poor marketing, and certification hurdles,” he noted.

He suggested Bangladesh could easily export a range of halal foods, particularly fish, meat, vegetables, fruits, apparel, and agro-products, if supported by proper promotion.

“Malaysia currently imports these items from India, Thailand, Vietnam, Italy, and the USA. Bangladeshi products like hilsa fish, mangoes, and RMG enjoy strong global demand but need effective marketing and certification,” he said.

“To enter Malaysia’s halal market, Bangladesh must sign an MoU with the Malaysian Halal Authority. Beyond Malaysia, the global halal market also offers huge opportunities for Bangladesh to earn foreign currency,” he added.

Dr Billah emphasised that Bangladesh should strengthen export diversification and train its large workforce in relevant skills and languages to secure sustainable economic growth.

Halal market: $7-8 billion opportunity by 2030

Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) President Shabbir A Khan said semiconductors and halal foods are two sectors that could significantly help reduce the trade imbalance.

“We have been working to boost bilateral trade, but the limited export basket remains a hurdle. The halal economy offers a new opening for Bangladesh,” he said.

Citing market data, he pointed out that the global halal food market, valued at $3.3 trillion in 2025, is projected to reach $9.45 trillion by 2034 with a CAGR (compound annual growth rate) of 12.42%.

“Malaysia, with its 32 million people, imports around $15 billion worth of halal food annually, projected to cross $50 billion by 2030. As a Muslim-majority country, Bangladesh could earn $7-8 billion annually by exporting halal products to Malaysia by 2030,” he explained.

However, he noted that dual certification requirements by the Islamic Foundation and BSTI cause confusion and hinder international acceptance.

“The private sector should step in to ensure certification that is globally recognised,” he added.

Semiconductor sector: Job creation and cooperation

The BMCCI president also underlined the scope of cooperation in semiconductors, where Malaysia ranks sixth globally with a projected market size of $19.41 billion in 2025.

“Malaysia will face a shortage of about 60,000 skilled professionals by 2030, but only 15,000 talents will be locally available. To fill this gap, Malaysia plans to outsource. We have signed MoUs to prepare Bangladeshi talents to enter this ecosystem,” he said.

He noted that Malaysia depends heavily on imported front-end semiconductor solutions such as chip design, architecture, and prototyping from Taiwan, South Korea, and the USA.

“Bangladesh, which has growing expertise in architectural engineering and chip design, can complement Malaysia in this sector,” he said.

A BMCCI delegation recently joined the Investment Summit 2025 in Kuala Lumpur, where MoUs were signed with MIMOS and ASEM to advance semiconductor innovation and talent training.

Regarding trade negotiations, Shabbir said progress on a Free Trade Agreement (FTA) with Malaysia has been slow, while Malaysia currently prefers a Preferential Trade Agreement (PTA).

MIHAS to boost ASEAN exports

Emphasising strong trade relations with Malaysia, Shabbir added that Bangladesh’s participation in the Malaysia International Halal Showcase (MIHAS) on 17-19 September 2025, would be crucial in showcasing exportable items to ASEAN and other Muslim countries.

“This is a great platform to expand trade and increase exports,” he said, adding that the registration process is underway.

The event will be held at Malaysia International Trade and Exhibition Centre (MITEC) in Kuala Lumpur.

Malaysian investments in Bangladesh

During a recent visit to Malaysia, Chief Adviser Prof Muhammad Yunus urged leading Malaysian conglomerates to invest in Bangladesh’s economic zones, affordable housing, ports, healthcare, and education.

Bangladesh Bank data shows that net FDI inflows from Malaysia to Bangladesh were $55.15 million in FY24, $34.61 million in FY23, $66.29 million in FY22, $8.77 million in FY21, and $22.15 million in FY20.

Investments mainly flowed into telecommunications, power, construction, pharmaceuticals, chemicals, textiles, and trading.

(The reporter can be reached at: [email protected])

Edited by: Anayetur Rahaman

TRADE WITH MALAYSIA

Big potential, bigger deficit

Despite five decades of ties, Bangladesh struggles to narrow a $2b trade gap due to poor export diversification, weak marketing, and certification hurdles

Despite more than five decades of diplomatic ties, Bangladesh has failed to reduce its trade deficit of over US$2 billion with Malaysia, mainly due to a lack of export diversification, market research, strategy, and certification processes.

Economists and industry insiders see strong potential in halal foods, fish, meat, vegetables, fruits, particularly mangoes, readymade garments (RMG), jute and leather goods, other agro-products, and skilled manpower in the semiconductor sector.

According to data compiled by the Dhaka Chamber of Commerce & Industry (DCCI) from the Export Promotion Bureau (EPB) and Bangladesh Bank, total bilateral trade stood at $2.92 billion in 2024, $2.79 billion in 2023, and $4.56 billion in 2022.

Bangladesh’s exports totalled $329.39 million in 2024, $329.18 million in 2023, and $325.16 million in 2022, leaving a trade gap of $2.26 billion, $2.13 billion, and $3.91 billion respectively.

‘Market research and diversification are key’

Speaking to the Daily Sun over phone, Dr Mohd Ma’Sum Billah, senior professor of finance at King Abdul Aziz University, said Bangladesh has been unable to fully tap the Malaysian market despite being a Muslim-majority country.

“The problem lies in weak market research, lack of export diversification, poor marketing, and certification hurdles,” he noted.

He suggested Bangladesh could easily export a range of halal foods, particularly fish, meat, vegetables, fruits, apparel, and agro-products, if supported by proper promotion.

“Malaysia currently imports these items from India, Thailand, Vietnam, Italy, and the USA. Bangladeshi products like hilsa fish, mangoes, and RMG enjoy strong global demand but need effective marketing and certification,” he said.

“To enter Malaysia’s halal market, Bangladesh must sign an MoU with the Malaysian Halal Authority. Beyond Malaysia, the global halal market also offers huge opportunities for Bangladesh to earn foreign currency,” he added.

Dr Billah emphasised that Bangladesh should strengthen export diversification and train its large workforce in relevant skills and languages to secure sustainable economic growth.

Halal market: $7-8 billion opportunity by 2030

Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) President Shabbir A Khan said semiconductors and halal foods are two sectors that could significantly help reduce the trade imbalance.

“We have been working to boost bilateral trade, but the limited export basket remains a hurdle. The halal economy offers a new opening for Bangladesh,” he said.

Citing market data, he pointed out that the global halal food market, valued at $3.3 trillion in 2025, is projected to reach $9.45 trillion by 2034 with a CAGR (compound annual growth rate) of 12.42%.

“Malaysia, with its 32 million people, imports around $15 billion worth of halal food annually, projected to cross $50 billion by 2030. As a Muslim-majority country, Bangladesh could earn $7-8 billion annually by exporting halal products to Malaysia by 2030,” he explained.

However, he noted that dual certification requirements by the Islamic Foundation and BSTI cause confusion and hinder international acceptance.

“The private sector should step in to ensure certification that is globally recognised,” he added.

Semiconductor sector: Job creation and cooperation

The BMCCI president also underlined the scope of cooperation in semiconductors, where Malaysia ranks sixth globally with a projected market size of $19.41 billion in 2025.

“Malaysia will face a shortage of about 60,000 skilled professionals by 2030, but only 15,000 talents will be locally available. To fill this gap, Malaysia plans to outsource. We have signed MoUs to prepare Bangladeshi talents to enter this ecosystem,” he said.

He noted that Malaysia depends heavily on imported front-end semiconductor solutions such as chip design, architecture, and prototyping from Taiwan, South Korea, and the USA.

“Bangladesh, which has growing expertise in architectural engineering and chip design, can complement Malaysia in this sector,” he said.

A BMCCI delegation recently joined the Investment Summit 2025 in Kuala Lumpur, where MoUs were signed with MIMOS and ASEM to advance semiconductor innovation and talent training.

Regarding trade negotiations, Shabbir said progress on a Free Trade Agreement (FTA) with Malaysia has been slow, while Malaysia currently prefers a Preferential Trade Agreement (PTA).

MIHAS to boost ASEAN exports

Emphasising strong trade relations with Malaysia, Shabbir added that Bangladesh’s participation in the Malaysia International Halal Showcase (MIHAS) on 17-19 September 2025, would be crucial in showcasing exportable items to ASEAN and other Muslim countries.

“This is a great platform to expand trade and increase exports,” he said, adding that the registration process is underway.

The event will be held at Malaysia International Trade and Exhibition Centre (MITEC) in Kuala Lumpur.

Malaysian investments in Bangladesh

During a recent visit to Malaysia, Chief Adviser Prof Muhammad Yunus urged leading Malaysian conglomerates to invest in Bangladesh’s economic zones, affordable housing, ports, healthcare, and education.

Bangladesh Bank data shows that net FDI inflows from Malaysia to Bangladesh were $55.15 million in FY24, $34.61 million in FY23, $66.29 million in FY22, $8.77 million in FY21, and $22.15 million in FY20.

Investments mainly flowed into telecommunications, power, construction, pharmaceuticals, chemicals, textiles, and trading.

(The reporter can be reached at: [email protected])

Edited by: Anayetur Rahaman