Print: 29 Oct 2025

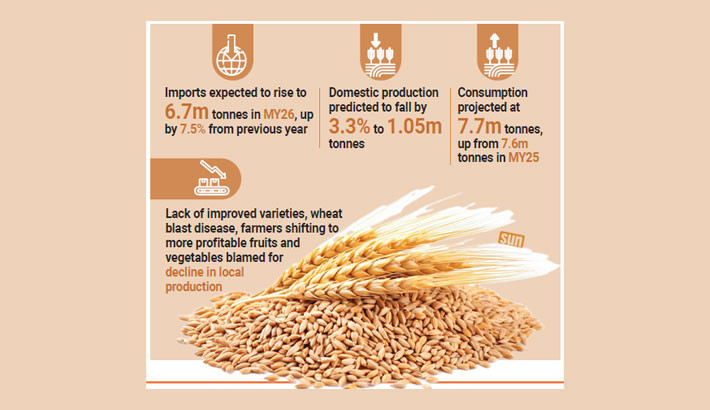

Bangladesh's reliance on imported wheat is expected to grow during the 2025-26 marketing year (July to June), driven by a decline in domestic production and a consistent rise in consumption.

The country's wheat imports are predicted to increase to 6.7 million tonnes in 26MY, a 7.5% rise from the previous year, according to the Grain and Feed Annual Report of the US Department of Agriculture (USDA).

This surge is attributed to higher demand from local food processors, stable international prices and a reliable global supply.

The government aims to import up to 700,000 tonnes of wheat from the Unit-ed States, with purchase agreements for 220,000 tonnes already finalised.

Post contacts expect lower international prices and stable supply to contribute to higher import volumes in MY26, according to USDA.

In Bangladesh, wheat is the second most prevalent staple food after rice and is used to some extent as an alternative to rice. Therefore, the demand for wheat flour is likely to continue to rise while rice prices remain high. Local produc-tion accounts for approximately 10% of total demand.

For MY25, Post revised its wheat import estimate to 6.24 million tonnes based on the latest trade data from the Ministry of Finance and the Ministry of Agri-culture.

According to finance ministry data, the private sector imported around 5.8 mil-lion tonnes of wheat, while the rest was imported by the government in MY25.

The government generally imports wheat for its public granaries, which are supplied for various social safety net programmes and procures wheat either through international tenders or through direct purchases under government-to-government agreements.

For FY26, the government has set an import target of up to 700,000 tonnes of wheat from the US. As of August 2025, the government finalised purchase agreements for 220,000 tonnes of US wheat.

For MY26, Post forecasts wheat harvested area and production lowered to 290,000 hectares and 1.05 million tonnes, down by 3.3% and 2.8% from post’s MY25 estimates, based on the revised crop production data of the De-partment of Agricultural Extension (DAE).

Post also adjusts the MY25 wheat cultivated area and production estimate at 300,000 hectares and 1.08 million tonnes, respectively, based on DAE’s re-vised data. The lack of improved varieties in Bangladesh has led to a gradual decline in both wheat acreage and production over time.

Wheat will be planted during the Robi season, between November and Decem-ber 2025 and harvested in March and April 2026.

Bangladesh primarily produces soft wheat. Soft wheat is suitable for making products like chapati (roti), biscuit, and cakes due to its lower protein content and lower gluten compared to hard wheat varieties, which are typically used for making strong gluten-based products like pasta and some types of bread.

Agricultural economist Dr Jahangir Alam told the Daily Sun that declining lo-cal production and rising consumption will make Bangladesh increasingly de-pendent on wheat imports.

“Domestic output is shrinking due to disease and shifting cropping patterns, while the demand continues to grow with higher rice prices and changing die-tary habits. Stable international prices help, but long-term dependency is a se-rious concern,” he said.

The lack of improved wheat varieties and outbreaks of wheat blast disease have reduced yields in the country. Wheat blast disease reduces yields signifi-cantly, and farmers are earning higher profits cultivating fruits and vegetables during the Robi season.

Food, seed and industrial (FSI) consumption trend

For MY26, Post increased the FSI wheat consumption forecast to 7.7 million tonnes, up by 1.3% from its MY25 estimate.

Post estimates MY25 FSI consumption at 7.6 million tonnes, up by approxi-mately 7% from MY24, based on rebounding demand for aata and maida at the household level, along with the higher demand for biscuits, confectionery, pasta, noodles and bakery items, according to USDA.

As rice prices have remained high for over a year, many households are now consuming more wheat flour than previously. The biscuit, noodle and pasta-making industry is expanding for home consumption and for export purposes.

In 2024-25 fiscal year, the total export value of wheat-based products from Bangladesh was estimated at $225 million. Common wheat-based products exported from Bangladesh include bread, pastry, cakes, sweet biscuits, roasted cereals and pasta.

Destinations include Saudi Arabia, Oman, Malaysia, the United Arab Emir-ates, the United Kingdom and the US.

Feed consumption for MY26

Post forecasts feed consumption of wheat at 300,000 tonnes. Depending on the type of feed produced (poultry, aquaculture or cattle) and other ingredient prices, feed mills include approximately 4-5% wheat flour. Some feed mills al-so use wheat bran in feed rations.

Sometimes the feed industry uses wheat bran and rice bran alternatively. Cattle farmers also feed wheat bran separately to their cows. For MY25, Post esti-mates feed use of wheat unchanged at 280,000 tonnes based on robust feed production to meet increased demand for various poultry, aqua and dairy feed.

The reporter can be reached at: [email protected]

Edited by Abdul Mukith

Wheat imports to rise amid falling output and growing demand

This surge is attributed to higher demand from local food processors and a reliable global supply

Bangladesh's reliance on imported wheat is expected to grow during the 2025-26 marketing year (July to June), driven by a decline in domestic production and a consistent rise in consumption.

The country's wheat imports are predicted to increase to 6.7 million tonnes in 26MY, a 7.5% rise from the previous year, according to the Grain and Feed Annual Report of the US Department of Agriculture (USDA).

This surge is attributed to higher demand from local food processors, stable international prices and a reliable global supply.

The government aims to import up to 700,000 tonnes of wheat from the Unit-ed States, with purchase agreements for 220,000 tonnes already finalised.

Post contacts expect lower international prices and stable supply to contribute to higher import volumes in MY26, according to USDA.

In Bangladesh, wheat is the second most prevalent staple food after rice and is used to some extent as an alternative to rice. Therefore, the demand for wheat flour is likely to continue to rise while rice prices remain high. Local produc-tion accounts for approximately 10% of total demand.

For MY25, Post revised its wheat import estimate to 6.24 million tonnes based on the latest trade data from the Ministry of Finance and the Ministry of Agri-culture.

According to finance ministry data, the private sector imported around 5.8 mil-lion tonnes of wheat, while the rest was imported by the government in MY25.

The government generally imports wheat for its public granaries, which are supplied for various social safety net programmes and procures wheat either through international tenders or through direct purchases under government-to-government agreements.

For FY26, the government has set an import target of up to 700,000 tonnes of wheat from the US. As of August 2025, the government finalised purchase agreements for 220,000 tonnes of US wheat.

For MY26, Post forecasts wheat harvested area and production lowered to 290,000 hectares and 1.05 million tonnes, down by 3.3% and 2.8% from post’s MY25 estimates, based on the revised crop production data of the De-partment of Agricultural Extension (DAE).

Post also adjusts the MY25 wheat cultivated area and production estimate at 300,000 hectares and 1.08 million tonnes, respectively, based on DAE’s re-vised data. The lack of improved varieties in Bangladesh has led to a gradual decline in both wheat acreage and production over time.

Wheat will be planted during the Robi season, between November and Decem-ber 2025 and harvested in March and April 2026.

Bangladesh primarily produces soft wheat. Soft wheat is suitable for making products like chapati (roti), biscuit, and cakes due to its lower protein content and lower gluten compared to hard wheat varieties, which are typically used for making strong gluten-based products like pasta and some types of bread.

Agricultural economist Dr Jahangir Alam told the Daily Sun that declining lo-cal production and rising consumption will make Bangladesh increasingly de-pendent on wheat imports.

“Domestic output is shrinking due to disease and shifting cropping patterns, while the demand continues to grow with higher rice prices and changing die-tary habits. Stable international prices help, but long-term dependency is a se-rious concern,” he said.

The lack of improved wheat varieties and outbreaks of wheat blast disease have reduced yields in the country. Wheat blast disease reduces yields signifi-cantly, and farmers are earning higher profits cultivating fruits and vegetables during the Robi season.

Food, seed and industrial (FSI) consumption trend

For MY26, Post increased the FSI wheat consumption forecast to 7.7 million tonnes, up by 1.3% from its MY25 estimate.

Post estimates MY25 FSI consumption at 7.6 million tonnes, up by approxi-mately 7% from MY24, based on rebounding demand for aata and maida at the household level, along with the higher demand for biscuits, confectionery, pasta, noodles and bakery items, according to USDA.

As rice prices have remained high for over a year, many households are now consuming more wheat flour than previously. The biscuit, noodle and pasta-making industry is expanding for home consumption and for export purposes.

In 2024-25 fiscal year, the total export value of wheat-based products from Bangladesh was estimated at $225 million. Common wheat-based products exported from Bangladesh include bread, pastry, cakes, sweet biscuits, roasted cereals and pasta.

Destinations include Saudi Arabia, Oman, Malaysia, the United Arab Emir-ates, the United Kingdom and the US.

Feed consumption for MY26

Post forecasts feed consumption of wheat at 300,000 tonnes. Depending on the type of feed produced (poultry, aquaculture or cattle) and other ingredient prices, feed mills include approximately 4-5% wheat flour. Some feed mills al-so use wheat bran in feed rations.

Sometimes the feed industry uses wheat bran and rice bran alternatively. Cattle farmers also feed wheat bran separately to their cows. For MY25, Post esti-mates feed use of wheat unchanged at 280,000 tonnes based on robust feed production to meet increased demand for various poultry, aqua and dairy feed.

The reporter can be reached at: [email protected]

Edited by Abdul Mukith